United Bank Limited (UBL) is one of the largest commercial banks in Pakistan, providing a comprehensive range of financial services to its customers. Founded in 1959, UBL has emerged as a leading player in the banking sector, offering a wide array of products and solutions to individuals, corporations, and institutions. With a commitment to customer satisfaction and innovation, UBL has built a strong reputation for its banking expertise and customer-centric approach. A Brief Overview and History of United Bank Limited UBL

History of United Bank Limited:

UBL was established in 1959 as a result of the merger of four banks. Over the years, it has witnessed significant milestones and transformations. In 1971, UBL became the first bank to establish a branch in Bahrain, marking its entry into international markets. In 1974, it was nationalized along with other major banks in Pakistan. However, in 2002, UBL was privatized and became a part of the private sector, leading to its expansion and modernization.

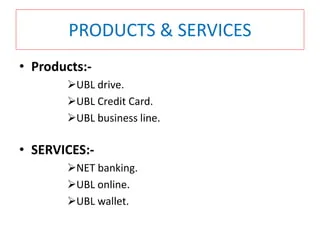

Services and Products Offered by UBL:

UBL offers a wide range of services and products to cater to the diverse needs of its customers. Its offerings include retail banking services such as

- Savings and Current Accounts

- Loans

- Credit Cards

- and Remittance Solutions.

For corporate and institutional clients, UBL provides specialized services like corporate finance, trade finance, treasury services, and cash management solutions. Additionally, UBL has embraced digital banking, providing convenient and secure online banking, mobile banking, and Internet payment solutions.

UBL’s Global Presence:

UBL has a significant presence both within Pakistan and internationally. In Pakistan, it operates through a vast network of branches and ATMs, serving customers across the country. Internationally, UBL has a global footprint with branches and subsidiaries in the

- United States

- United Kingdom

- Qatar

- UAE

- Bahrain

- Switzerland, and many other countries.

This global presence enables UBL to facilitate international trade, remittances, and financial services for its customers.

Corporate Social Responsibility (CSR) Initiatives:

The bank focuses on education and healthcare, supporting programs and initiatives that promote access to quality education, healthcare facilities, and skill development. UBL also partners with non-profit organizations and charitable institutions to address social issues and contribute to community development.

Technology and Innovation in UBL:

UBL recognizes the importance of technology and innovation in enhancing customer experience and driving operational efficiency. The bank has invested in advanced banking technologies and digital solutions to provide convenient and secure banking services. UBL’s digital platforms enable customers to perform transactions, access account information, and avail banking services through online and mobile channels.

Awards and Recognitions:

The bank has received accolades in various categories, including

- Best Bank

- Best Digital Bank

- and Best Customer Service.

These awards highlight UBL’s achievements and reinforce its position as a leading financial institution in Pakistan.

Conclusion:

United Bank Limited (UBL) has established itself as a prominent player in the banking sector, with a rich history, extensive range of services, global presence, and commitment to corporate social responsibility. UBL’s focus on technology and innovation ensures that customers have access to convenient and secure banking solutions. Through its relentless pursuit of excellence, UBL continues to make significant contributions to the financial landscape of Pakistan and beyond. A Brief Overview and History of United Bank Limited UBL