Bank of America, a renowned global financial institution, boasts a captivating history that encompasses over a century of remarkable achievements. Originating as the Bank of Italy in 1904, it has evolved into a dominant force in the banking industry, influencing the contemporary financial landscape and making substantial contributions to the economic prosperity of not only the United States but also the world at large. This article presents a comprehensive overview of Bank of America’s illustrious history, delving into its significant milestones, transformative mergers and acquisitions, pioneering initiatives, and unwavering dedication to serving the best interests of its customers and communities. History Of Bank Of America

Founding and Early Years

Bank of America traces its roots back to 1904 when Amadeo Peter Giannini, the son of Italian immigrants, founded the Bank of Italy in San Francisco. At that time, traditional banks primarily served the wealthy, leaving the vast immigrant population underserved. Giannini aimed to change this by providing accessible banking services to ordinary people.

The Bank of Italy quickly gained popularity through its innovative practices. Giannini emphasized customer service, extended banking hours, and offered small loans to working-class individuals who were previously unable to access credit. The bank’s success led to its expansion throughout California.

Merger with Bank of America, Los Angeles

n 1928, the Bank of Italy and the Bank of America, Los Angeles, executed a deliberate merger that resulted in the formation of the Bank of America. This strategic transaction aimed to extend the bank’s influence beyond the boundaries of California and establish a robust nationwide presence. Under the leadership of Giannini, the newly amalgamated Bank of America commenced a journey of sustained growth and expansion.

Expansion and Diversification

Throughout the 20th century, Bank of America continued to expand its operations and diversify its services. In the 1930s, it weathered the challenges of the Great Depression, supporting customers and businesses through difficult times. The bank also played a crucial role in the financing of major infrastructure projects, including the Golden Gate Bridge and the construction of Hoover Dam.

After World War II, Bank of America recognized the potential of consumer credit and pioneered the development of the modern credit card. In 1958, it launched the BankAmericard, which later evolved into the Visa credit card, revolutionizing the way people make payments and further expanding the bank’s customer base.

International Expansion and Global Reach

Bank of America’s growth extended far beyond national boundaries as it embarked on an expansion into international markets. During the 1980s, the bank strategically pursued acquisitions to establish its footprint globally. In 1984, it notably acquired the Continental Illinois National Bank and Trust Company, a prominent financial institution. This transaction facilitated the bank’s expansion into the Midwest region, granting it access to a wider customer base and bolstering its operations in that area.

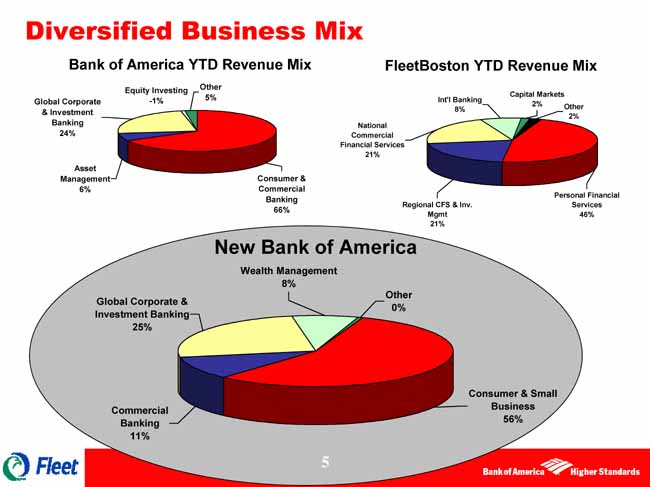

In the 1990s and early 2000s, Bank of America further solidified its global reach through acquisitions and mergers. The acquisition of NationsBank in 1998 was a pivotal moment for Bank of America as it propelled the institution to become one of the largest banking entities in the United States. This strategic merger united two formidable organizations, leveraging their collective resources, expertise, and customer bases for mutual growth and success.

Financial Crisis and Recovery

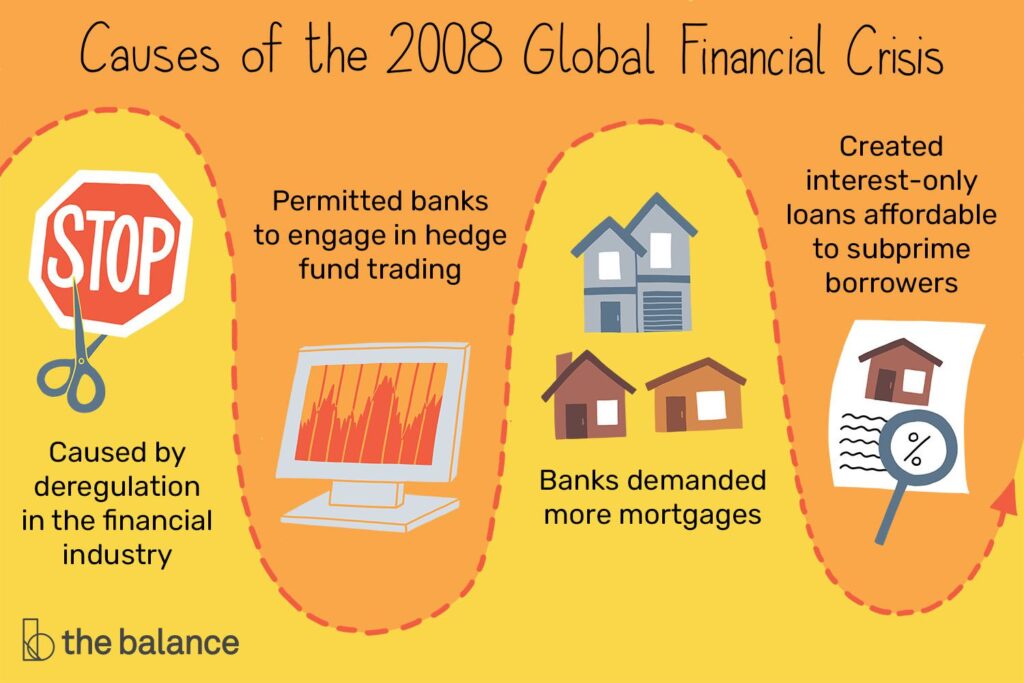

The advent of the global financial crisis in 2008 brought forth significant challenges for the banking industry, and Bank of America was not immune to its consequences. The bank faced substantial setbacks due to its acquisition of Countrywide Financial, a mortgage lender profoundly impacted by the downturn in the housing market. In light of these challenges, Bank of America swiftly implemented a range of strategic initiatives to stabilize its operations and effectively navigate through the crisis.

During this period, the bank received financial assistance from the U.S. government as part of the Troubled Asset Relief Program (TARP). This support, combined with strong leadership and a focus on risk management, helped Bank of America weather the storm and emerge as a more resilient institution.

Commitment to Sustainability and Social Responsibility

Bank of America has consistently exhibited a robust commitment to sustainability and social responsibility. The bank has proactively embraced environmental conservation, making significant investments in renewable energy projects and actively supporting initiatives dedicated to reducing carbon emissions.It has also played a significant role in financing affordable housing and community development projects, empowering underserved communities, and driving positive change.

Moreover, Bank of America has prioritized diversity, equity, and inclusion within its own ranks and in the communities it serves. The bank has implemented programs and initiatives to promote diversity and equal opportunities, fostering a more inclusive work environment and supporting diverse-owned businesses.

Conclusion

Bank of America’s history exemplifies its remarkable resilience, adaptability, and steadfast commitment to customer service. Initially founded as the Bank of Italy, the institution has undergone a profound transformation, effectively overcoming economic challenges, expanding its footprint, and diversifying its range of services. Presently, Bank of America has emerged as a prominent global leader in the financial industry, persistently driving innovation, fostering economic growth, and actively contributing to the welfare of its customers and communities. TodayAims.com History Of Bank Of America